A central bank digital currency (CBDC) is a virtual currency issued by a central bank. It is likely the first state-issued digital form of money and is a digital currency that central banks plan to adopt over the next few years. CBDCs offer many benefits, including reduced cost and increased adaptability. Country-backed digital currencies are more centralized than Bitcoin and other cryptocurrencies. CBDCs are also known as digital fiat currencies.

A CBDC is backed by a central bank instead of a traditional commercial bank. The central bank of the issuing country regulates them. Unlike virtual currencies, CBDCs have a legal tender status. The advantage of this is that it could reduce the cost of borrowing money, as banks would not be needed in the process.

Central Bank Digital Currencies, or CBDCs, are the latest cryptocurrency trend. Countries like Canada and Switzerland have already been discussing introducing CBDCs. The downside is that these country-backed digital currencies are more centralized than decentralized cryptocurrencies.

The idea behind CBDCs is that if people believe the currency is stable and trustworthy, they will be more likely to use it for transactions rather than relying on other digital currencies, like Bitcoin, which has no intrinsic value.

Like Bitcoin and other cryptocurrencies, CBDCs have their consensus and supply. The governments will control the supply and demand of the currency. CBDCs are also more stable because the government’s fiat currency backs them.

The central bank issues government-backed digital currencies in the issuing country. When a government-backed digital currency is issued, it replaces cash in circulation and is usually accepted by citizens to pay taxes and bills. The government regulates, oversees, and manages the issuance of these currencies. Even private sector-led central bank digital currency projects will be regulated by the central bank.

Who would use a CBDC?

Financial institutions and other financial services providers, such as insurers and asset managers, would primarily use a wholesale CBDC. Retail CBDCs, on the other hand, would mainly appeal to consumers.

CBDCs, however, can be accessed only by specific economic actors for interbank payments and securities transactions. This might not be disruptive as, in an efficient economy, domestic banks can already make transactions with each other using reserves held in the national central bank, allowing fast transactions using the real-time gross settlement (RTGS) system.

Fractional reserve CBDCs, on the other hand, can be issued by a bank for its use and sold as legal currency. This type of CBDC allows banks to create money for their customers and lend it out for more than they originally borrowed. Thus, if a bank creates 100 dollars’ worth of CB, DC will only possess 10 dollars’ worth of this currency.

The international financial system’s current limitation is its inability to process cross-border transactions. To make the global economy more efficient and better suited for the 21st century, a wholesale CBDC system would need to be implemented.

Banks in different countries could benefit from implementing this architecture. This could reduce transaction time, costs, and errors. Using Blockchain protocols, businesses can increase profits while improving efficiency and reducing costs.

The current system seems inefficient because many domestic banks do not hold accounts in foreign central banks, requiring the latter to process cross-border transactions through other networks or foreign partners. Similarly, retail CBDCs could improve efficiency in retail cross-border payments. In this case, central banks must allow foreign entities to own liquidity in the CBDC.

In a token-based system, the CBDC would have a pre-set balance that it can transact with, which would let it tote more than just the cryptocurrency of its choice. However, this system is not suitable for the account-based approach, as it is not able to complete transactions in cryptocurrencies since it does not have control over its own balance.

Instead, the account-based system would work well with a hybrid of these two systems. The account-based system is a good fit for the CBDC since it allows for more transactions than just cryptocurrencies, but it will not have anonymity. An individual’s identity would be verified and recorded on the blockchain to ensure they are not using multiple accounts to transact under various identities. Further, several cross-chain compatibility issues would be solved. An individual’s identity on their account could be transferred to a new blockchain to use on the other while still maintaining their identity and not worrying about losing crypto during the transfer.

The US Federal Reserve initially developed an account-based system, which was later adopted by central banks worldwide. The system is beneficial because it allows central banks to hold accounts, manage credit/debit transactions, and verify the identities of the two parties involved. It also provides a secure system for processing and storing transactions digitally while providing more security than a traditional paper-based system.

This is an economic risk, as it could prevent the central bank from issuing new tokens, as it could not cover the interest payments on existing ones. This creates a macroeconomic downside risk of inflation if interest rates increase to compensate for this shortfall. On the other hand, central banks could use token-based CBDCs to target different areas of liquidity and the risk of inflation if interest rates are increased. For example, a central bank could issue a CBDC that is issued solely to provide digital asset holdings for open market operations (rather than CBDCs that would be used for lending). Suppose a central bank has to increase interest rates because it needs more liquidity. In that case, only the CBDC providing liquidity for open market operations would be affected, rather than the CBDCs for all other purposes. The risks to the central bank are more complex, as there is less transparency about how a decentralized digital asset works. This could make imposing policy difficult and lead to market bubbles if not adequately enforced. This is an economic risk, as it could cause inflation or fluctuating exchange rates.

To make the CBDCs appealing to individuals, they would need to make interest rates on these tokens attractive. However, people may only want to hold the token to receive interest payments, which can lead to central bank failure. These banks could also run into problems if their economies are unable or unwilling to support the levels of debt necessary to sustain the CBDCs.

The central bank-issued digital currency is also unaffected by technological flaws and operational failures. If there is a problem with the technology that underlies the cryptocurrency, it could lead to a loss of confidence in the token, making people hold less and spend more on traditional currencies. The risks of holding a centrally issued digital currency

Meanwhile, an account-based system cannot guarantee fully anonymous transactions. It would require central banks to manage many retail and corporate accounts, increasing the risk of disintermediation of incumbent financial institutions. Some central banks have also proposed a hybrid system in which token-based CBDCs are integrated into a closed architecture of certified accounts to maximize the benefits of the two systems while mitigating the adverse effects.

The research paper further argues that the immediacy of central bank money, in contrast to commercial bank money, would lead to higher velocity, increased monetary efficiency, and lower interest rates.

A central bank digital currency (CBDC) is issued by a central bank directly to consumers or institutions. The first CBDC was the Danish Kroner in 1967. In the United Kingdom, the first commercial central bank to issue a CBDC was Northern Rock in 2007. The paper argues that the immediacy of central bank money, in contrast to commercial bank money, would lead to higher velocity, increased monetary efficiency, and lower interest rates.

A report from the Bank for International Settlements (BIS) has been published, stressing that distributed ledger technology might not provide significant gains in terms of efficiency and costs compared to a central bank issuing its own digital currency.

Niepelt argued that CBDCs could be stored in accounts, prepaid cards, or decentralized database structures. A recent paper published by the Bank of Canada highlights that a conventional centralized system could support a CBDC, incorporating some properties of a blockchain, such as immutable data or smart contracts.

A CBDC is a digital central bank issued by the central bank to provide unit-like electronic currency units, distinct from physical cash or paper money. However, there are some differences between cryptocurrency and a CBDC, such as that CBDCs would retain the policy independence of their issuing institution and would be implemented in an Centralized verification process

Centralization of the CBDC means it is more likely that these transactions will be carried out on a centralized platform instead of a decentralized one. This is because, with a centralized system, the bank can more easily verify the trustworthiness of transactions and information. While there are complications associated with this particular model

It is essential to keep intermediaries’ scope of activities narrow, as they are subject to greater regulatory scrutiny than central banks. The distribution channel must also be capable of scaling up later. This means that it must facilitate the development of CDBCs into large-scale national offerings without requiring a significant overhaul in administrative procedures or operational practices.

The CDBC could be distributed to different intermediaries, such as banks or digital companies. These intermediaries can help with the distribution of the CDBC and manage its cash inflows and outflows, as well as provide other services such as cash transfers. The prototype of the CDBC is currently operating in Kenya and has been tested with more than 1,000 members.

The former scenario would allow central banks to pursue a more aggressive and direct policy of disintermediation. Conversely, the latter scenario would produce more intermediation, making central banks irrelevant and subject to market forces.

The Bank of Canada (BoC) has been discussing with the Financial Stability Board (FSB) the potential effects that a discontinuation of demand deposits might have on credit provision. The FSB has identified it as an issue that would be best solved through a coordinated approach by the BoC and other banks.

This second scenario is not without its risks. The Fed’s policy rate would not remain constant, and the transaction costs for open market operations would increase. Some argue that the central bank should be able to maintain a fed funds rate near 0 percent if it aims to maintain price stability. However, banks may charge higher interest rates on their term loans by limiting access to demand deposits.

What is a bank’s deposit?

A deposit is a short-term loan to an institution such as a building society, a credit union, or a bank to fund current transactions and provide liquidity. Deposits are typically managed by the banking system as part of its overall operations rather than by each financial institution.

The idea of an international payment currency is not new. However, combining this idea with the virtual currency market is a new approach that Canadian and Singaporean companies have implemented. They have already made it happen and are only waiting for regulations to be in place before the project can be completed.

The two central banks want to develop a common DLT platform for all future CBDC experiments. In an interview with Cointelegraph, Singapore Central Bank and MAS Deputy Managing Director (Digital) Kok Heng Leun said that the two countries use Quorum, IBM’s blockchain framework. , to develop a common DLT platform. He said: “We are using Quorum, IBM’s public blockchain framework and one of their offerings, currently in development, to build a platform for future CBDC experiments.”

Some early cross-border CDBC experiments have been pivotal in envisioning what a CBDC experiment could look like. These experiments provide a blueprint and guide for when and how to introduce these digital assets into the market.

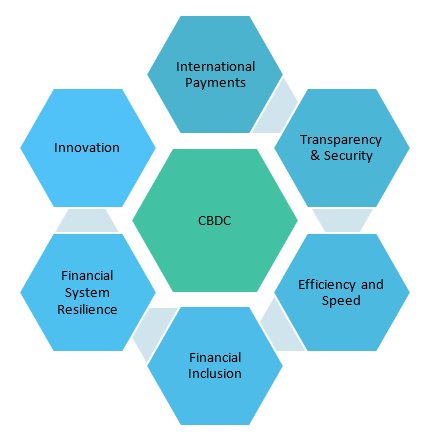

| Feature | Current Limitations | Potential Benefits of CBDC |

| Financial Inclusion | Unbanked populations lack access to financial services. | Direct access to electronic payments and financial products, potentially reducing inequality. |

| Efficiency and Speed of Payments | Traditional cross-border payments can be slow and expensive. | CBDCs can enable instant and low-cost cross-border payments. |

| Monetary Policy Effectiveness | Central banks struggle to control money supply with cash and traditional banking systems. | CBDCs can allow for more direct and efficient monetary policy implementation. |

| Financial System Resilience | Cash-based systems are vulnerable to counterfeiting and theft. | CBDCs can be more secure and less susceptible to fraud. |

| Innovation and Financial Inclusion | Limited access to financial data hinders innovation in financial services. | CBDCs can create new opportunities for financial products and services based on real-time data. |

| Government Revenue Collection | Tax evasion is a challenge in cash-based economies. | CBDCs can improve tax collection and transparency. |

| Competition and Private Sector Innovation | Incumbents may dominate traditional financial systems. | CBDCs can create a level playing field for new entrants and promote innovation in financial services. |

| Privacy Concerns | Central bank control over financial data raises privacy concerns. | CBDCs can be designed with robust privacy protections to ensure individual data is not compromised. |

| Technical Challenges | Implementing and scaling CBDCs requires significant technical expertise and infrastructure. | CBDC development requires careful planning and collaboration between central banks, private sector, and academia. |

| Transparency & Security | Fraud, money laundering, counterfeiting | Central bank control can enhance security and combat financial crime. |

| International Payments | Cross-border transactions are slow and expensive | Faster, cheaper, and more secure cross-border payments, boosting international trade. |

Table 7-1: Benefits and Limitations of CBDC

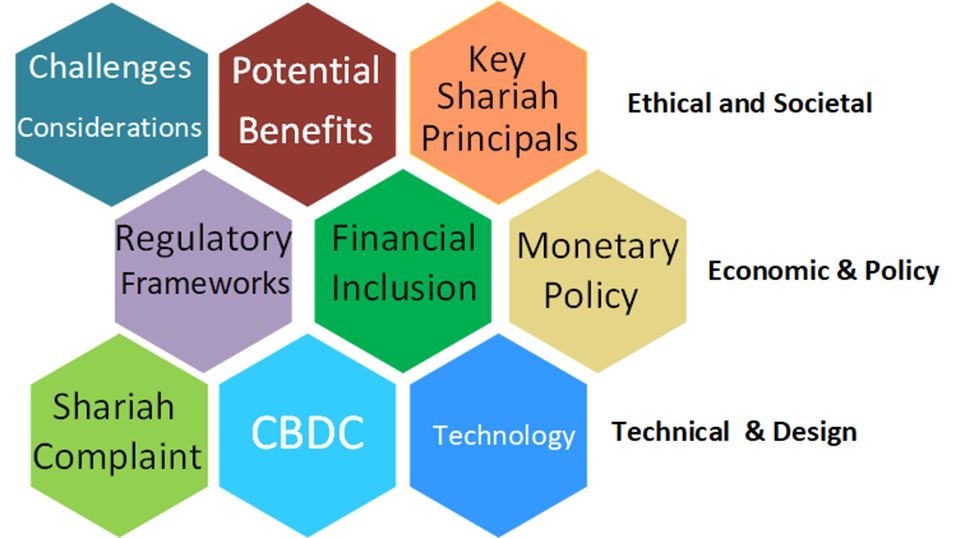

Figure 7-2: Purpose of CBDC

Fintech

Fintech is the financial technology industry that has evolved in recent years. It is a sector that has taken the world by storm. Fintech is a financial industry that deals with the transfer of value and information through digital technologies. It is a system of services that uses technology and electronic systems to manage money and other assets. Fintech has grown rapidly, with companies like Apple and Google investing heavily. Fintech has changed the financial industry, and many opportunities for people looking to make money online. The fintech market is expected to exponentially grow in the coming years and will be worth more than $5 trillion by 2030. The fintech industry is expected to grow rapidly because there are many opportunities for innovation in the financial sector. The traditional financial sector is a significant part of the economy. The fintech industry’s growth has occurred partly because banks are losing money.

It’s a digital platform that uses technology to improve how financial institutions, such as banks, perform their services. With over 4,000 businesses, the worldwide fintech sector is expected to be worth $3 trillion.

The market is rapidly growing and will continue to grow in the coming years. Fintech companies are taking over the market by driving innovation, cost-cutting and competitive pricing. Traditional banks are struggling to remain competitive and adapt to the demands of this new digital market. The fintech industry has also created high-paying jobs and contributes $23 billion in revenue to the US economy.

In recent years, banks have lost trillions of dollars to cybercrime and beleaguered third-party businesses. One big reason for this is the high innovation in the financial technology sector. The banking sector is also facing many challenges, and its response to these changes has been slow so far.

Spending patterns in the fintech industry are similar to those in other sectors of the economy, with many consumers relying on credit cards and loans to finance their spending. Fintech lending is expected to grow rapidly, as consumers who previously relied on banks for loans now turn to these alternative lenders. Bank lending is projected to remain flat in the 2020s and 2030s and fall sharply.

The banking sector is also facing many challenges, and its response to these changes has been slow so far. Spending patterns in the fintech industry are similar to those in other sectors of the economy, with many consumers relying on credit cards and loans to finance their spending. Fintech lending is expected to grow rapidly, as consumers who previously relied on banks for loans now turn to these alternative lenders. Bank lending is projected to remain flat in the 2020s and 2030s and fall sharply.

Cashless

A cashless economy is an economy that uses electronic forms of money with no physical paper bills, coins, or tokens. Cashless economies are gaining popularity as people embrace this type of economy in various countries. Recently, the World Bank released a report on cashless economies, which stated that four countries have already achieved this milestone – Sweden, Denmark, Hong Kong, and Canada. While most people are used to cash, many countries have moved to a cashless economy. This is the case with Finland and Sweden, which have the world’s highest cashless penetration rates at 86% and 78%, respectively.

According to the World Bank’s report on cashless economies, a cashless economy has several benefits. Most importantly, it promotes financial inclusion by giving the impoverished and unbanked access to financial services. People who cannot afford credit cards or ATMs can still enjoy their basic needs, such as food and shelter, by carrying out transactions in digital currencies instead of physical currency.

This topic is relevant because it has occurred worldwide, mainly in developing countries and countries with unstable economies. This has made it harder for people to manage their money since all forms of payment are electronic and require credit cards or digital wallets. While not everyone likes how this system works due to the high level of control corporations like banks hold over people’s lives, some countries say these systems make their economies more efficient and smooth-running.

Some countries are eliminating cash to combat inflationary central banks that issue paper currency. Others are eliminating cash to eliminate crime. Some countries eliminate cash (either through legislation or by forcing vendors to only accept payments in digital form) to combat criminal activities, including money laundering, narcotics trafficking, and terrorist financing.

In Cyprus, the confiscation of more extensive banknotes was essential to the (2013–14) Cypriot financial crisis. Policies for limiting cash use have successfully reduced criminal activities and boosted tax revenue. However, there is a risk that people may be less likely to report profits from criminal activity that is not regularly noticed by law enforcement; this could result in overestimating the crime rate. There is also the risk of individuals using cash to carry out illicit activities.

The most recent Task Force on Money Laundering report from the Organisation for Economic Co-operation and Development points out that the typical high-denomination banknote is used in 13.7 percent of crime compared to 1.2 percent for just €50 notes, 0.02 percent for $20 notes, and 0.003 percent for £10 notes. In other words, high-value banknotes are used more for criminal activity. “Cash is the currency criminals use to launder money because it can be converted into and out of legal tender with relative ease,” says John Cassara, partner at the law firm White Case.

In recent years, companies have found more and more ways to rely on technical progress despite the market’s current economic disorder. For example, China’s devaluation of its currency has led to increased faith in technological progress rather than an increase in the value of its money.

The Chinese have also suspended trading in the Shanghai market for unknown periods. The European Central Bank (ECB) has announced a new plan to save Europe from its economic woes, and yet the cost of the bailout and uncertainty about who will be forced to take part in it are still looming. Europe is being scrutinized because of instability in Italy and Greece, where bailouts are also being considered. The United States is also considering a bailout of its own. To prevent markets from crashing, the ECB created a $1 trillion program to purchase sovereign debt and corporate bonds to finance governments needing funds and banks that have assets they cannot value. However, while this plan is good in theory, the cost of funding the European Union is still unknown. It is also uncertain how much of the $1 trillion will be borrowed and what countries will be forced to participate in the bailout. While it was announced that Spain would not have to contribute, there are still talks about what will happen in Italy and Greece.

In times of market volatility, decentralized cryptocurrency assets such as Bitcoin might provide alternatives, maintaining a secure financial system. However, it’s important to remember that crypto is “trustless,” and there is no intermediary to ensure that cryptocurrency holdings can be protected or easily transferred to another entity. Crypto assets are not insured, so it’s important for investors not to invest more than they can afford to lose to maintain a level of financial security.

Role of Central Banks

A country or economy with a central bank is usually called a monetary authority, reserve bank, or simply central bank. Central banks often have wide hidden jurisdictions, can issue government-backed currency (notes and coins), and oversee the commercial and financial systems of their respective countries.

A new report from the Bank for International Settlements (BIS) states that although there’s no universally accepted definition of a “Central Bank Digital Currency,” most people envision it as a new form of money different from traditional reserve balances.

Cryptocurrency-based central banks (CBDCs) were created as a type of digital currency. However, CBDCs are issued by the government and have the legal status of money.

The concept of CBDCs was inspired by Bitcoin & cryptocurrency that works under the same Blockchain principles. The idea of CBDCs was inspired by Bitcoin & cryptocurrency that works under the same Blockchain principles. CBDC stands for Central Bank Digital Currency, and it’s not a cryptocurrency as we know it (Bitcoin) but rather a digital currency issued by a state with an official legal tender status.

Country-backed digital currencies are more centralized than Bitcoin and other cryptocurrencies. The central bank of the issuing country regulates them. Unlike virtual currencies, CBDCs have limited tokens in circulation, which can be likened to digital cash. The idea behind CBDCs is that if people believe the currency is stable and trustworthy, they will be more likely to use it for transactions rather than relying on other digital currencies, like Bitcoin, which has no intrinsic value. In contrast, decentralized virtual currencies like Bitcoin have no central bank and are not backed by a country or other governing body.

In this currency system, the money supply can be created through token creation and destruction. The two main types of central bank digital currencies include government-backed (bank-issued) digital currencies and private-sector-led central bank digital currency projects, also known as “cryptocurrencies.” The central bank issues government-backed digital currencies in the issuing country. When a government-backed digital currency is issued, it replaces cash in circulation and is usually accepted by citizens to pay taxes and bills. The government will regulate, oversee, and manage the issuance of these currencies. The central bank will regulate private-sector-led central bank digital currency projects.

The first cryptocurrency to attract a lot of interest was Bitcoin. It was introduced in 2009 by a person or group, and it was governed by the pseudonym Satoshi Nakamoto. More than 19.8 million bitcoins were in use as of January 2, 2025, and their combined market worth was around $1.89 trillion (albeit the bitcoin price can vary significantly).

The majority of CBDC solutions will probably not require or employ a distributed ledger, such as a blockchain.

| Bank | Core Responsibility | ||

| Supranational Central Bank | Global monetary stability | financial development | |

| Regional Central Bank | Monetary policy | Currency management | regional financial stability |

| National Central Bank | Monetary policy, | Currency Management | Banking supervision |

| Currency Board | Limited Monetary policy | Currency peg | |

| Central Bank of Issue | Limited Monetary policy | Currency issuance | |

Table 7-2: Banks Core responsibility

CBDCs are primarily theoretical, with some central banks discussing building a prototype. They’re popular because they can reduce the need for currency storage, save money, and speed up transactions.

China’s digital RMB was the first to be released into circulation, and it has had help from the two largest internet companies in China, which make up more than 50% of all web traffic.

Singapore:

Will Cryptocurrencies be legalized?

Singapore has a strong stance on cryptocurrencies, but their legality is still being debated. In 2013, Singapore’s central bank said it would not recognize Bitcoin as a currency and warned citizens about the risks of investing in cryptocurrencies.

The Monetary Authority of Singapore (MAS) also told banks to discourage their customers from trading in digital currencies and ordered banks to report suspicious transactions. In 2014, the MAS changed its stance on Bitcoin and said that as long as they are not used as a payment method for illegal activities or to finance terrorism, Bitcoin traders would be allowed to operate without any regulatory restriction. In 2017, MAS took a more progressive stance towards cryptocurrencies, underlining the importance of diversifying Singapore’s economic base and promoting innovation.

Blockchain central banks are still mainly in the experimental stages. However, a few existing ones have functioning proofs of concept. Christine Lagarde, the ECB chief, has said that 80+ central banks are looking into building their own digital currencies, like China’s digital RMB.

The Bank of England is also considering digitizing the pound. Central banks have been hesitant to fully embrace blockchain because of security concerns. However, central banking is changing rapidly, and blockchain could become a viable option when they are ready to do so.

Let’s use an analogy. The world is like a huge party, and the blockchain is like a bouncer controlling who enters the party. In this analogy, central banks are the financial world’s bouncers; they control what types of financial products enter their system and how much money can flow through it daily.

The traditional system has much more control than its decentralized counterpart, so a central bank’s decision could have wide-reaching consequences for markets. For example, if JP Morgan Chase decided that it would no longer service Bitcoin futures contracts, the price of Bitcoin could drop. Blockchain technology has come a long way since its inception in 2008. Recent data suggests that the number of Bitcoin daily transactions is currently around 312,513. This is a notable decline from earlier times and is impacted by market activity generally, transaction costs, and network congestion.

The blockchain is up to 450 gigabytes, growing by 2.5 GB per minute.

Proponents say it would be easier to transact with digital money, especially in remote regions, expensive parts of the world, or even on Mars. It also allows individuals to hold multiple currencies without lugging around their savings in a safe or a piggy bank. However, critics say they could be vulnerable to hacking, and governments must limit how much individuals can send abroad. Some countries also worry that giving digital versions of their currencies a legal standing could dilute the value of paper money.

A digital currency issued by a central bank is known as a CBDC. Some experts, including economist Jimmy Song, argue that a CBDC would not affect the availability of money because the central bank could still print physical cash. However, this would end financial regulation, consumer protection laws, and banking regulations. A CBDC does not necessarily exist in its digital currency, but it is the new benchmark for what money is.

| Type of Central Bank | Description | Key Functions | Examples |

| Supranational Central Bank – International | Oversees the monetary policy and currency of a group of countries across multiple regions. | – Promoting global monetary stability – Providing financial assistance to countries in crisis – Supporting economic development – Issuing special drawing rights (SDRs) | International Monetary Fund (IMF), World Bank (only indirectly through lending to member states) |

| Regional Central Bank – (Multinational) | Responsible for managing the monetary policy and currency of a group of countries within a specific region. | – Coordinating monetary policy across member states – Issuing a common currency – Promoting regional financial stability – Providing regional financial services | European Central Bank (EU), Central Bank of West African States (ECOWAS), Eastern Caribbean Central Bank (ECCB) |

| National Central Bank- (National) | The primary monetary authority of a single country, responsible for formulating and implementing monetary policy, managing the national currency, and overseeing the banking system. | – Setting interest rates – Managing money supply – Issuing currency – Overseeing financial stability – Providing lender of last resort | Federal Reserve System (USA), Bank of England (UK), People’s Bank of China (China) |

| Currency Board – (National) | A monetary authority that pegs the national currency to a foreign currency or a basket of currencies, with limited control over monetary policy. | – Maintaining a fixed exchange rate – Ensuring price stability – Limiting the ability to set independent monetary policy – Bringing stability after periods of hyperinflation | Hong Kong Monetary Authority (HKMA), Argentina’s Convertibility Board (1991-2001) |

| Central Bank of Issue – (National) | Responsible for printing and issuing the national currency, but may not have full control over monetary policy. | – Issuing and managing the national currency – Managing the government’s cash reserves – May play a role in financial regulation and oversight | Bank of Canada (until 1967), Reserve Bank of India (until 1935) |

Table 7-3: Key functions of Central banks

CBDC Architecture

| Categorize | Component | Description |

| Program Management | Regulatory Framework | Laws and regulations governing CBDC issuance, use, and oversight. |

| Complexity | technical and institutional complexity of designing and implementing a CBDC system | |

| Business Model | Monetary Policy Control | Refers to the central bank’s tools and instruments for managing the money supply and influencing economic activity. These tools include interest rates, reserve requirements, and quantitative easing. |

| Transparency | The protection of individuals’ financial information and transaction data from unauthorized access or disclosure | |

| Financial Inclusion | ensuring that everyone has access to a range of safe and affordable financial services, including CBDC | |

| Business Architecture | Account Management | System for opening, managing, and closing individual accounts. |

| Payment Processing | Handles transaction initiation, validation, and settlement. | |

| Technology Architecture | Transactions | Refers to the process of transferring digital central bank currency (CBDC) units between individuals or entities. Transactions can be peer-to-peer (without intermediaries) or involve authorized intermediaries like banks. |

| Core Ledger | Central record of all CBDC units and transactions. | |

| Identity Management | Verifies and authenticates users for access and transactions. | |

| Security & Privacy | Protects user data, transactions, and system integrity. | |

| IS Architecture | Privacy | the protection of individuals’ financial information and transaction data from unauthorized access or disclosure |

| Efficiency | Refers to the ability of the CBDC system to process transactions quickly, cheaply, and reliably. This includes aspects like transaction speed, settlement finality, and scalability. | |

| Technology Infrastructure | Hardware, software, and networks supporting CBDC operations. |

Table 7-4: Architectural components in CBDC

| Component | Direct Model | Indirect Model | Hybrid Model |

| Regulatory Framework | Central Bank sets and enforces regulations. | Intermediaries comply with regulations set by the Central Bank. | Hybrid approach with potential for both Central Bank and intermediary-specific regulations depending on account type and system interaction. |

| Complexity | Requires central bank to handle all transactions and account management, increasing complexity. | Less complex for the central bank, but complexity may be shifted to intermediaries. | Complexity can vary depending on the chosen hybrid model and its implementation. |

| Monetary Policy Control | Central bank has direct control over money supply and monetary policy instruments. | Central bank control is indirect, relying on intermediaries. | Central bank control can be tailored based on account type and transaction type. |

| Transparency | Central bank has full transparency into all transactions. | Limited transparency for the central bank, relying on intermediaries’ reports. | Transparency can be tailored based on account type and transaction type. |

| Financial Inclusion | Potential for disintermediation of unbanked or underbanked populations. | Reaches unbanked/underbanked through existing financial structures. | Can offer both direct access for unbanked and leverage existing structures for wider reach. |

| Account Management | Individuals directly hold accounts with the Central Bank. | Individuals hold accounts through authorized intermediaries. | Individuals have choice of account types: Central Bank or intermediary. |

| Payment Processing | Individuals initiate and settle transactions directly with the Central Bank. | Intermediaries initiate and settle transactions with the Central Bank on behalf of users. | Individuals can initiate transactions with both Central Bank and intermediaries depending on chosen account type. |

| Transactions | Individuals directly transact with the central bank using digital wallets. | Individuals transact through intermediaries who then settle with the central bank. | Individuals can transact directly or through intermediaries depending on their account type. |

| Core Ledger | Central Bank Ledger (CBL) | Central Bank Ledger (CBL) | Central Bank Ledger (CBL) |

| Identity Management | Central Bank manages user identities. | Intermediaries manage user identities within their systems. | Hybrid approach with potential for central and intermediary identity management depending on account type. |

| Security & Privacy | Central Bank responsible for security and privacy of individual data. | Intermediaries responsible for security and privacy within their systems. | Hybrid approach with varying levels of responsibility for security and privacy depending on account type and system interaction. |

| Privacy | Privacy concerns due to central bank holding all account data. | Privacy concerns may be mitigated by intermediaries managing data. | Privacy can be balanced based on account type and transaction type, with stronger privacy for indirect accounts. |

| Efficiency | Potentially more efficient due to fewer intermediaries. | Less efficient than direct model, but leverages existing infrastructure. | Efficiency can vary depending on the chosen account type and transaction method. |

| Technology Infrastructure | Central Bank maintains and operates its own infrastructure. | Intermediaries leverage existing infrastructure with potential for Central Bank connections. | Hybrid approach with Central Bank infrastructure and integration with intermediary systems. |

Table 7-5: Modules of CBDC Models

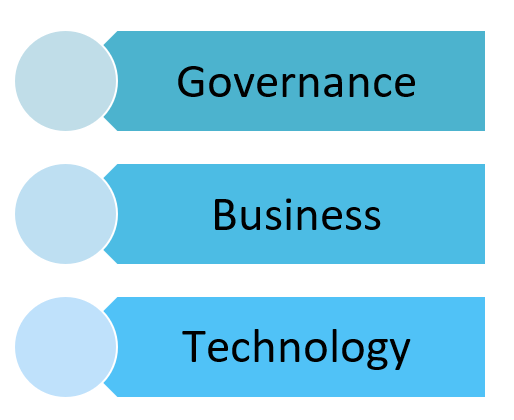

| Layer | Categorize | Component |

| Governance | Program Management | Regulatory Framework |

| Complexity | ||

| Business Model | Monetary Policy Control | |

| Business | Transparency | |

| Financial Inclusion | ||

| Business Architecture | Account Management | |

| Payment Processing | ||

| Technology | Technology Architecture | Transactions Based on (Account or Token or Hybrid) |

| Core Ledger (Public, Private, Consortium, Hybrid) | ||

| Identity Management | ||

| Security & Privacy | ||

| IS Architecture | Privacy | |

| Efficiency | ||

| Technology Infrastructure |

Figure 7-3: Architecture of CDBC

Design Consideration for CBDC

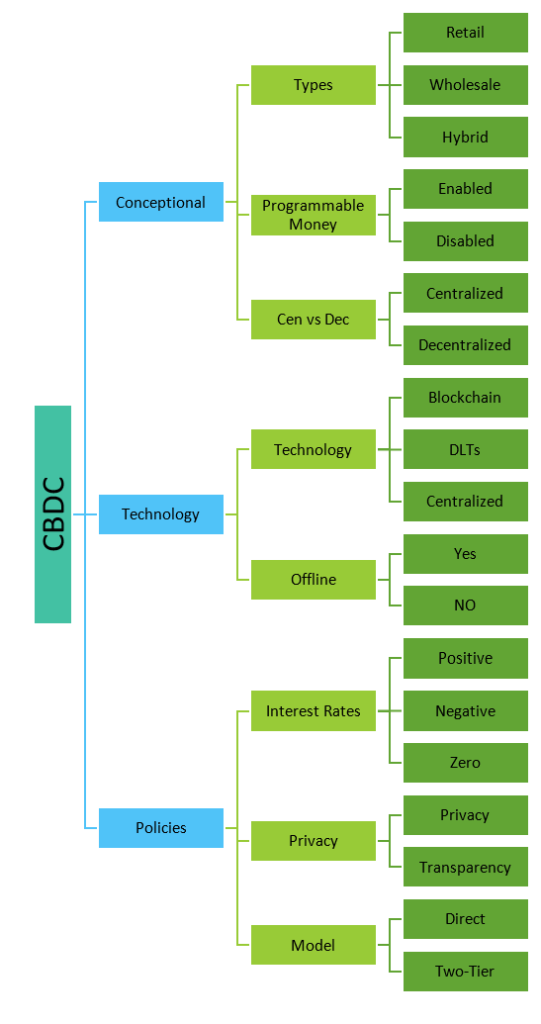

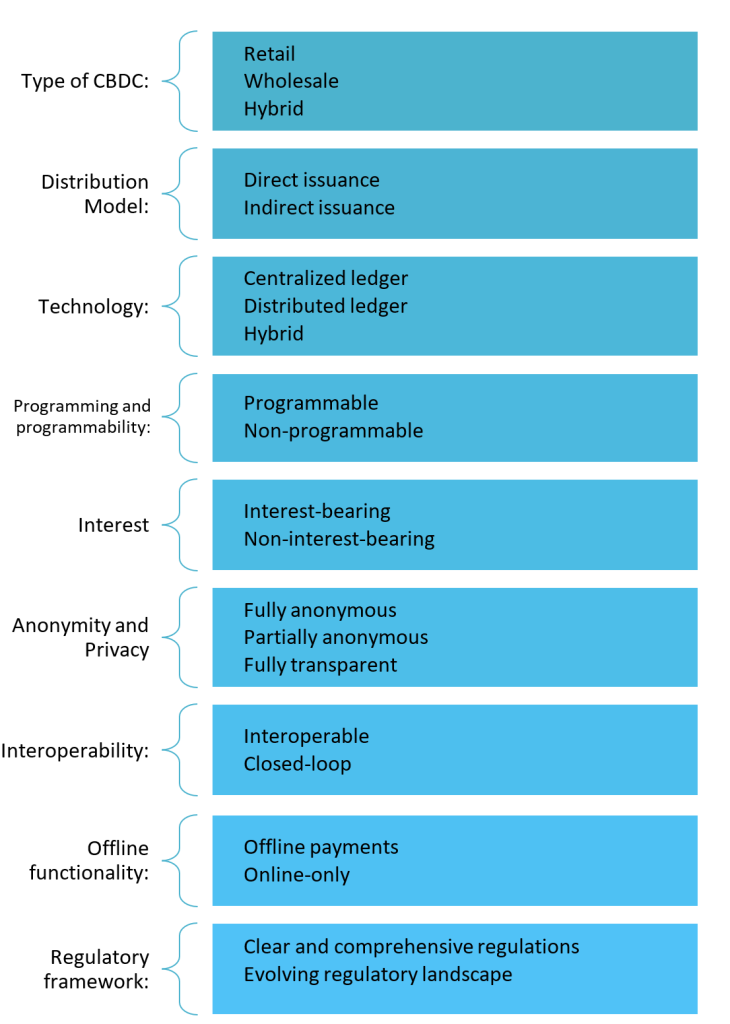

Designing a Central Bank Digital Currency (CBDC) involves key conceptual, technological, and policy decisions. Conceptually, CBDCs can be retail, wholesale, or hybrid and may be centralized or decentralized. They can also be programmable, enabling targeted uses, and interoperable with existing financial systems. Technological choices include blockchain, centralized ledgers, or distributed ledger technologies, with considerations for security, offline functionality, and scalability. Policy considerations include distribution methods (direct, two-tier, or indirect), privacy levels (strong, greater transparency, or transparent), interest rates (positive, negative, or zero), and regulatory frameworks (unambiguous, dynamic, or financial inclusion-focused). These choices will influence the CBDC’s usability, security, and economic stability.

Conceptual Decisions

- Type of CBDC:

- Retail: Accessible to everyone for everyday transactions.

- Wholesale: Primarily for interbank settlements and large-value transactions.

- Hybrid: Combines elements of both retail and wholesale.

- Centralized vs. Decentralized:

- Centralized: Controlled entirely by the central bank.

- Decentralized: Uses blockchain technology for greater transparency and distribution.

- Programmable Money:

- Enabled: The CBDC can be programmed with specific conditions for use, enhancing efficiency and targeting specific goals.

- Disabled: No additional functionality beyond basic transactions.

- Interoperability: Ability to seamlessly interact with existing financial systems and other CBDCs.

- Interoperable: Ability to seamlessly interact with other payment systems and currencies. Important for cross-border transactions.

- Closed-loop: Limited interaction with other systems, potentially hindering adoption and efficiency.

Technological Decisions

- Underlying Technology:

- Blockchain: Offers transparency and security but may have scalability limitations.

- Centralized ledger: The central bank will have complete control and oversight.

- Other distributed ledger technologies: A distributed ledger is shared across multiple nodes, potentially offering greater transparency and security. It can provide similar benefits with potentially better scalability.

- Centralized database: Simpler and faster, but raises concerns about privacy and control.

- Security: Robust measures to protect against cyberattacks and fraud.

- Offline Functionality:

- Enabled: Allows transactions without internet access, essential for financial inclusion.

- Disabled: Requires an online connection for all transactions.

Policy Decisions

- Interest Rate:

- Positive: Encourages holding and reduces the risk of excessive spending.

- Negative: Discourages holding and incentivizes spending or investment.

- Zero: Maintains neutrality between holding and spending.

- Privacy vs. Transparency:

- Strong privacy: Protects user data and anonymity, but may hinder crime prevention.

- Fully anonymous: No personal information linked to transactions.

- Increased transparency enables better AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) controls but raises privacy concerns.

- Partially anonymous: Some level of traceability for anti-money laundering and other purposes.

- Fully transparent: All transactions are publicly visible, raising privacy concerns.

- Strong privacy: Protects user data and anonymity, but may hinder crime prevention.

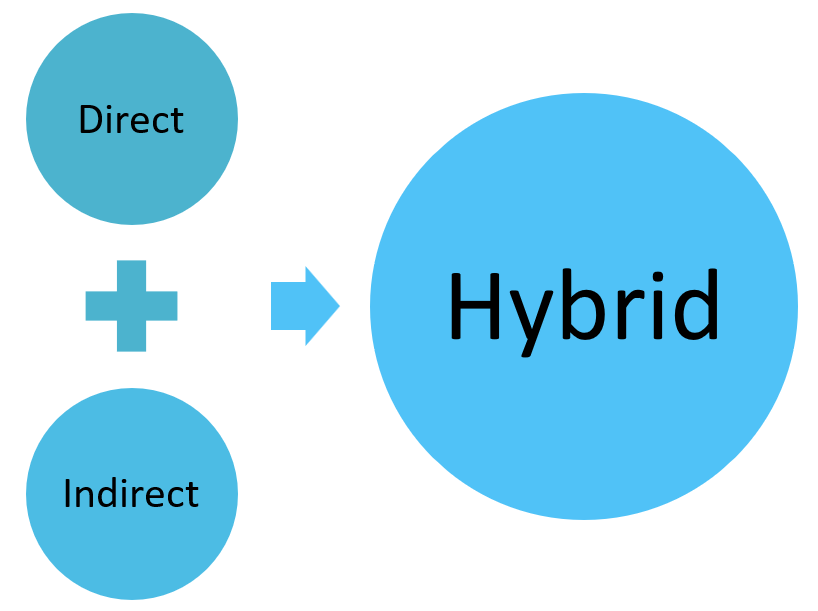

- Distribution Model:

- Direct: The central bank issues CBDC directly to users.

- Two-tier: The central bank issues to commercial banks, which then distribute to users.

- Indirect issuance: Through financial institutions or other intermediaries.

- Regulatory framework:

- Clear and comprehensive regulations: Provide certainty for users and businesses.

- Evolving regulatory landscape: Uncertainty can hinder adoption and innovation.

- Financial Inclusion: Ensuring access for all demographics, especially those without traditional bank accounts.

Figure 7-6: Design Considerations for CBDC

Approach for a CBDC

The approach for implementing a CBDC involves a multi-faceted strategy, prioritizing security, efficiency, and inclusivity. Firstly, the central bank will establish a clear legal and regulatory framework, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Next, a hybrid architecture will be adopted, combining the benefits of distributed ledger technology (DLT) with existing payment infrastructure to facilitate seamless integration and scalability.

The CBDC will be designed with a tiered system, comprising a wholesale segment for interbank settlements and a retail segment for consumer transactions. To promote financial inclusion, the CBDC will incorporate offline capabilities and user-friendly interfaces for low-tech users. Additionally, robust security measures, including advanced cryptography and secure key management, will safeguard transactions and protect user data. Finally, a phased rollout will enable incremental testing, refinement, and evaluation of the CBDC’s performance, ensuring minimal disruption to the existing financial ecosystem.

Approach 1: BASIC

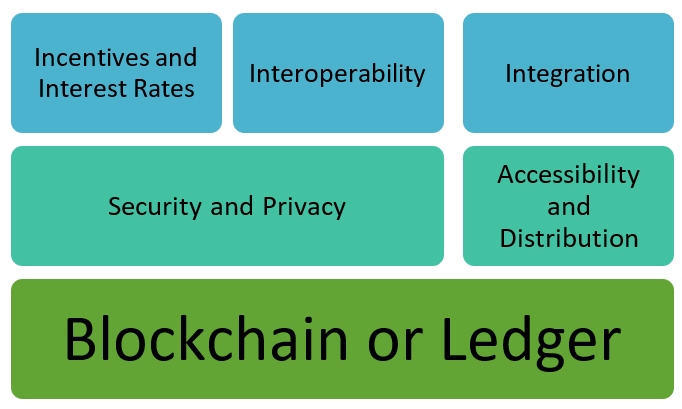

Designing a CBDC involves numerous critical decisions that impact its functionality, security, and economic impact. Let’s delve into some of the BASIC elements of CBDC design:

B: Blockchain or Traditional Ledger?

Blockchain offers transparency, immutability, and the potential for programmability. It requires robust and scalable infrastructure, which may result in high energy consumption.

Traditional Ledger: A familiar technology for central banks, enabling faster transaction processing and lower energy consumption. Less transparency and programmability compared to blockchain.

A: Accessibility and Distribution

Retail CBDC: Accessible to all citizens through digital wallets or other interfaces. Requires robust identity verification and fraud prevention systems.

Wholesale CBDC: Limited access only for financial institutions. Enhances interbank settlements and wholesale transactions.Hybrid CBDC: Combines features of both retail and wholesale models. Offers flexibility but requires careful design to avoid complexity.

S: Security and Privacy

Strong cryptographic protocols: Essential for protecting user data and ensuring transaction integrity. The balance between robust security and user privacy needs careful consideration.

Anonymity vs. Traceability: Trade-off between user privacy and the ability to track and prevent criminal activity. Regulatory considerations come into play. Offline Functionality Is Important for financial inclusion and resilience against outages. Requires innovative solutions for authentication and transaction storage.

I: Incentives and Interest Rates

Interest-bearing CBDC: Attracts users but can disrupt the existing banking system and monetary policy.

Non-interest-bearing CBDC: Encourages use for transactions but may struggle to compete with existing alternatives.

Tiered interest rates: Balancing incentives with potential drawbacks needs careful calibration.

C: Interoperability and Integration

- Compatibility with existing payment systems: Crucial for widespread adoption and reducing friction.

- Cross-border transactions: Potential for streamlining international payments but requires coordination between nations.

- Open APIs and programmability: Enable innovation and development of new financial services built on the CBDC.

Figure 7-4: Approach 1: BASIC

Approach 2: Technical Stack

A Central Bank Digital Currency (CBDC) can be designed in various ways, considering factors such as type (retail, wholesale, or hybrid), technology (distributed ledger or centralized), and distribution model (direct or indirect issuance). Additional design elements include interest rates (interest-bearing or non-interest-bearing), offline functionality, privacy and anonymity levels (full, controlled, or none), and interoperability with existing payment systems or standardized global platforms. Regulatory frameworks can range from clear and comprehensive to flexible, and pilot programs are essential for testing and refining the design.

These considerations impact CBDC’s functionality, security, financial inclusion, and overall effectiveness, requiring carefully balancing contending priorities to ensure successful implementation. Designing a Central Bank Digital Currency (CBDC) involves numerous crucial decisions that impact its functionality, security, and overall impact. Here are some key fundamental design decisions to consider:

Figure 7-7: Approach 2: CBDC

Type of CBDC

Retail CBDC: Accessible to individuals and businesses for everyday transactions.

Wholesale CBDC: Primarily for interbank settlements and large-value transactions.

Hybrid CBDC: Combines features of both retail and wholesale CBDCs.

Technology

Distributed ledger technology (DLT): Offers transparency, security, and immutability.

Centralized ledger: This approach is more traditional but raises concerns about transparency and control.

Distribution Model

Direct issuance: The central bank directly issues CBDC to individuals and businesses.

Indirect issuance: Through intermediaries like banks or financial institutions.

Interest Rate:

Interest-bearing: This could incentivize holding and using CBDC but impact monetary policy.

Non-interest-bearing: Simpler to implement and manage but might not be as attractive to users.

Offline Functionality:

Offline payments: Enables transactions without internet access, essential for financial inclusion.

Online-only: More efficient and secure, but excludes users without internet access.

Privacy and Anonymity:

Complete anonymity: Difficult to implement and raises concerns about money laundering and illegal activities.

Controlled anonymity: Balances privacy with regulatory compliance and crime prevention.

Interoperability:

Compatibility with existing payment systems: Easier integration and adoption, but might limit innovation.

Standardized platform across countries: Enables cross-border transactions and potentially fosters global financial integration.

Regulatory Framework:

Clear and comprehensive regulations: Ensures transparency and protect users, but can stifle innovation.

Flexible approach: Allows adaptation to evolving technologies and market needs but might create uncertainty.

Pilot Programs and Testing:

- Testing and experimentation: Crucial for identifying potential issues and refining design before full launch.

- Public engagement and feedback: Helps ensure the CBDC meets the needs and concerns of stakeholders.

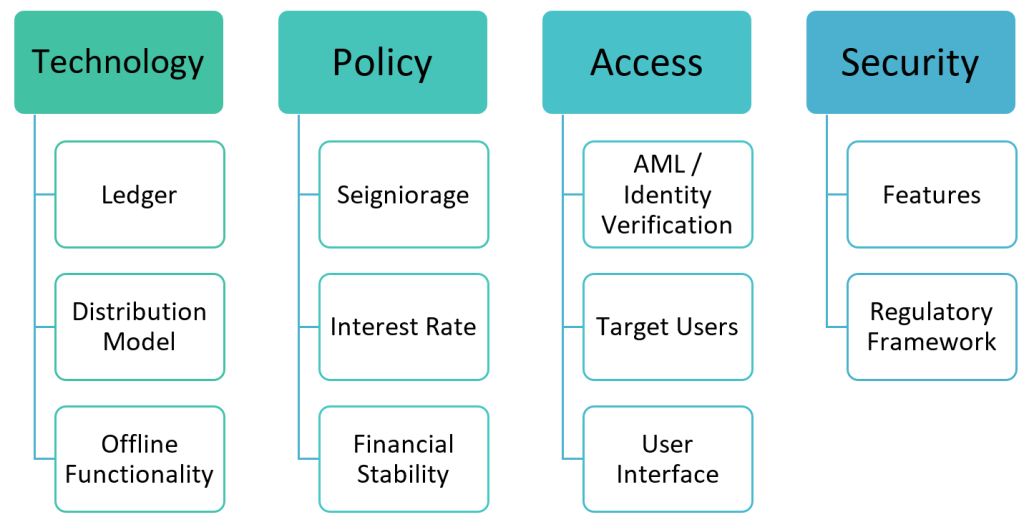

Approach 3: Business Stack

Designing a Central Bank Digital Currency (CBDC) requires careful consideration of four key areas. Firstly, the technology infrastructure must be chosen, including the type of ledger and distribution method. Secondly, monetary policy decisions, such as interest rates and profit management, will impact the financial system. Thirdly, ensuring accessibility and inclusivity for diverse user groups is crucial. Finally, balancing user privacy with regulatory requirements and implementing robust security measures is essential. By addressing these factors, central banks can create a secure, efficient, and user-friendly digital currency that supports financial stability, innovation, and economic growth.

Figure 7-5: Approach 3: CBDC Approach

Technology:

Ledger Technology: Choosing the underlying technology for the CBDC platform, such as blockchain, distributed ledger technology, or a centralized database. Each option offers different benefits and drawbacks regarding scalability, security, privacy, and efficiency.

Distribution Model: Determining how the CBDC will be distributed to users, whether directly by the central bank or through intermediaries like banks and financial institutions.

Offline Functionality: Deciding whether the CBDC will be usable in offline environments can be crucial for financial inclusion in areas with limited internet access.

Monetary Policy and Financial Stability:

Interest Rate: Determining whether the CBDC will pay interest and, if so, at what rate. This can impact its attractiveness and potentially impact the existing monetary system.

Seigniorage: Deciding how the profits generated from issuing the CBDC will be managed and distributed.

Financial Stability: Considering potential risks to the economic system, such as bank disintermediation or systemic liquidity shocks, and implementing safeguards to mitigate them.

Access and Inclusion:

Target Users: Defining who will be eligible to use the CBDC and ensuring accessibility for different population segments, including those with limited digital literacy or access to technology.

User Interface: Designing a user-friendly interface for accessing and using the CBDC, considering different technical expertise and literacy levels.

Identity Verification and Anti-Money Laundering: Implementing robust mechanisms for compliance with identity verification and anti-money laundering (AML) to prevent misuse and illegal activity.

Privacy and Security:

Privacy Features: Striking a balance between user privacy and the need for transparency for regulatory and AML purposes. Potential options include anonymous, pseudonymous, and zero-knowledge proofs.

Security Measures: Deploying robust security measures to protect against cyberattacks, fraud, and other threats. This includes securing the underlying technology, user data, and transactions.

Regulatory Framework: Developing a clear regulatory framework for the CBDC, outlining its legal status, governance structure, and regulatory oversight mechanisms.

These are just some key design decisions involved in developing a CBDC. Each country must carefully consider its specific needs and objectives when making these choices. The path forward will be shaped by ongoing research, experimentation, and public dialogue to ensure a CBDC that is efficient, inclusive, and beneficial for the entire financial system

Types of CBDC

Figure 7-8: Types of CBDC

Wholesale CBDCs

A central bank, usually the Federal Reserve, issues wholesale CBDCs. These wholesale CBDCs are created from traditional fiat currencies and can be used like any other cryptocurrency. In a wholesale CBDC structure, the CBDC would be issued directly to entities in line with the time-of-day needs of banks’ balance sheets. A Retail CBDC is different; instead, people can decide for themselves the extent of asset-backed tokens they want to own.

In contrast, in the case of a wholesale CBDC, the bank would give out CBDC to third parties, who could then use it to buy and sell with others. The main difference between the two systems is that retail CBDCs rely on a ‘full-fledged’ central bank issuing currency units, whereas wholesale CBDCs rely on third-party providers. The wholesale CBDC model has many potential problems. The biggest issue is liquidity. Because the system works on a fractional reserve model, it is possible for people to hold a large number of deposits and have no need to withdraw them. Banks could run out of cash, disrupting the financial markets. Private CBDCs would have fewer regulatory burdens and be able to innovate more quickly. A private CBDC would not be subject to the same capital requirements for banks as a public CBDC intended to reach a viable scale. Some private CBDCs could collapse because they cannot fund themselves from operations, and their value could fall below zero.

The main difference between wholesale CBDCs and other cryptocurrencies is their associated fiat currency value. The use cases of wholesale CBDCs include A means of payment for cross-border transactions, A way to limit volatility in crypto markets, A way to introduce greater stability into the crypto market, an instrument to help stabilize the economy and prevent inflationary pressures, A tool for central banks to reduce risks and hedge against inflation. There have been many proposals to create a CBDC (central bank digital currency) of various forms and names, such as the “Fedcoin” proposed by writers Paul Vigna and Michael Casey. The Federal Reserve would issue the Fedcoin, which could be used to settle transactions in place of cash or keep reserves with banks. Former President Obama also proposed a CBDC in June 2014, which was met with skepticism.

Retail CBDCs

The world’s first digital retail currency, the CBDC, has circulated since early 2016. Retailers using these digital currencies can instantly receive payments without payment fees. CBDCs, also known as virtual dollars, come with many benefits, such as instant transactions and low processing fees.

The Retail CBDC would be issued on a fully decentralized basis, and individuals would have the option of using them as collateral for other transactions on a peer-to-peer basis or trading them in exchange for different types of assets.

The retail CBDC allows consumers to use the tokens in their wallets to purchase goods and services at the point of sale. The retailer will receive an equivalent amount of fiat currency in exchange for the digital token. Sometimes, the retailer can use this as a form of payment for future transactions with their suppliers.

The largest current example of such a currency is the Chinese Yuan Renminbi. This digital method has allowed for further development in finance with new and more complex monetary instruments. For example, China has introduced a bond market with an interest rate that fluctuates based on the currency’s value. “The European Union is considering making its own “currency” to stop other countries from devaluing their own currency by trading with euros during times of crisis.

Unlike the wholesale CBDC, the retail version is expected to have no instant access and will have to be redeemed for cash through ATMs or banks. This implies that the settlement of retail payments will take longer than RTGS. The capitalization of a wholesale CBDC would be linked to creditworthiness and liquidity levels, whereas a retail one can be made of any denomination, which means that transactions will be cheaper.

A retail CBDC is not expected to be fully backed by the central bank, and its launch should function without any disruptions as long as the objective is to offer an alternative to cash. Retail CBDCs could increase convenience, but due to their design, they are likely to see a fall in anti-money laundering and counter-terrorist finance compliance, especially in developing countries where those institutions are lacking.

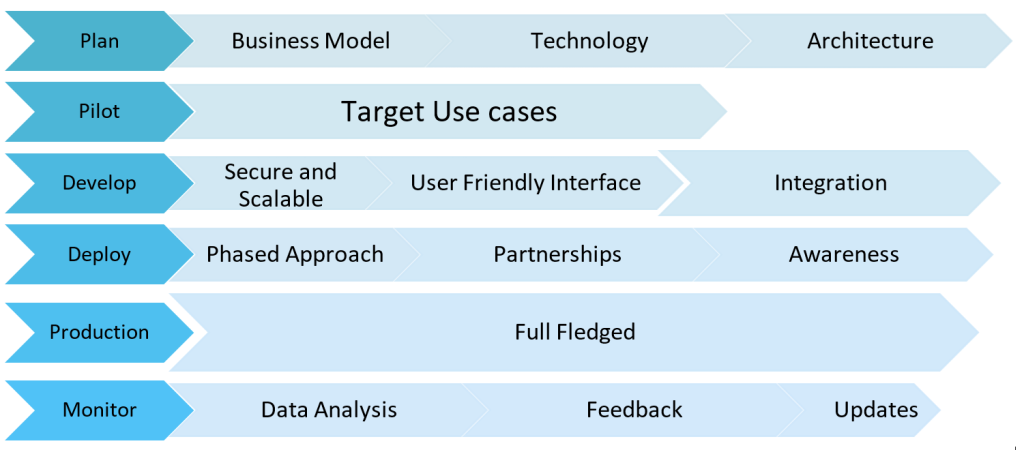

Implementation

Central banks around the world are considering the potential for issuing their own digital currency. A central bank digital currency would likely be implemented using a database run by the central bank, government, or approved private-sector entities.

Figure 7-9: Implementation phases for CBDC

The database would record the amount of money invested by every entity, such as individual people and big organizations. Those records would be held with appropriate privacy and security measures and encrypted to protect them from being accessed by anyone else but the original entity. The data will be accessible only to those with access to such information (with the users’ consent). Data would be used to decide if someone needs a loan or to make a payment.

| Stage | Description | Key Considerations | Challenges |

| Planning & Design | Defining the purpose, scope, and target audience for the CBDC. Choosing the appropriate architecture (direct, indirect, or hybrid) and technology stack. | *- Goals: Financial inclusion, efficiency, monetary policy control, etc. – Target audience: Retail, wholesale, cross-border payments, etc. – Technology: Scalability, security, privacy, interoperability. | – Regulatory clarity – Technological feasibility – Public awareness and acceptance |

| Pilot Phase | Test CBDC functionality, user experience, and impact on financial system. | *- Limited scale and scope to gather data and feedback. – Focus on specific use cases and Target groups. – Iterative design and development based on pilot results. | |

| Development & Testing | Building the core infrastructure, including ledgers, wallets, and payment systems. Conducting pilot tests to evaluate functionality and user experience. | *- Secure and scalable ledger Technology – User-friendly wallets and interfaces – Integration with existing payment systems | – Technical complexity – Cybersecurity risks – User adoption and behavior |

| Deployment & Launch | Rolling out the CBDC to the target audience. Creating access points and educating users. Monitoring and adjusting the system as needed. | *- Phased approach, starting with Limited groups – Public education and awareness campaigns – Partnerships with Financial institutions and Technology providers | – Managing competition with existing payment methods – Maintaining system stability and security – Addressing privacy concerns |

| Full Launch and Rollout | Gradual or widespread introduction of CBDC to the public. | *- Comprehensive communication and public education campaign. – Secure and robust infrastructure for large-scale transactions. – Integration with existing payment systems and financial institutions. | – Managing potential disintermediation of traditional banks. – Ensuring equitable access and digital literacy for all citizens. – Addressing security risks and cyber threats. |

| Monitoring & Adaptation | Continuously evaluating the CBDC’s performance and impact. Adapting and evolving the system based on feedback and data. | *- data analysis and performance monitoring – User feedback and satisfaction surveys – Regulatory adjustments and updates | – Balancing innovation with stability – Responding to changing needs and technological advancements – Addressing emerging risks and vulnerabilities |

Table 7-7: Implementation Stages in CBDC

Figure 7-10: Implementation plan for CBDC.

A blockchain or other distributed ledger would not be necessary or valuable for a central bank digital currency, which differs from cryptocurrencies in that it would be centralized, even if stored on a distributed database.

One notable difference between cryptocurrencies and “centralized” or government-managed digital currencies is that one typically doesn’t need a blockchain or other decentralized database to implement the latter.

Tech platforms are creating self-contained ecosystems that develop based on their own needs for their platforms, leading to a segmented digital world. For instance, the Internet is so intertwined with society that it has developed an ecosystem of its own. Platforms such as Facebook are incentivized to develop their digital economy because they are not competing for efficiency in the traditional marketplace. Additionally, platforms may want to control what people can and cannot do on their platforms, which has led to the development of digital sovereignty and rights. The Internet’s impact on society has been the most revolutionary and far-reaching in human history, mainly because it is new. The growth of digital sovereignty and rights and the long-term social repercussions of the Internet will be fascinating to watch.

Users of digital currency should be able to send and receive money from anybody else at minimal costs and latency without requiring a bank to act as a middleman. Bank-mediated transactions are becoming a thing of the past. Technological advances have increased the number of digital currencies, most notably Bitcoin, still the most popular currency.

Digital Currency as a Financial Inclusion Tool The potential of digital currency to promote financial inclusion is one of its many noteworthy advantages. Financial inclusion refers to the initiatives countries undertake to ensure all individuals can access the economic system, borrow money, and save money. The idea is to give people the tools to build credit history, access banking services, and manage their finances.

A lack of international regulation and oversight has created an environment where transaction records are open-ended. Financial institutions in developed nations have been susceptible to data breaches, resulting in the loss of personal information. According to the Council on Foreign Relations research, “the United States is losing more than 100,000 records per day.” The involvement of many actors, who often have little oversight from governments or regulators, has led to the proliferation of fraudulent activities that expose consumers and financial institutions to identity theft and fraud. For example, in 2017 alone, there were 218 data breaches reported by retail stores across the globe—the second-highest number in history.

| Feature | Direct Architecture | Indirect Architecture | Hybrid Architecture |

| Account Management | Individuals directly hold accounts with the central bank. | Individuals hold accounts with authorized intermediaries (e.g., banks) who settle with the central bank. | Individuals can choose between direct and indirect accounts. |

| Transactions | Individuals directly transact with the central bank using digital wallets. | Individuals transact through intermediaries who then settle with the central bank. | Individuals can transact directly or through intermediaries depending on their account type. |

| Monetary Policy Control | Central bank has direct control over money supply and monetary policy instruments. | Central bank control is indirect, relying on intermediaries. | Central bank control can be tailored based on account type and transaction type. |

| Efficiency | Potentially more efficient due to fewer intermediaries. | Less efficient than direct model, but leverages existing infrastructure. | Efficiency can vary depending on the chosen account type and transaction method. |

| Transparency | Central bank has full transparency into all transactions. | Limited transparency for the central bank, relying on intermediaries’ reports. | Transparency can be tailored based on account type and transaction type. |

| Privacy | Privacy concerns due to central bank holding all account data. | Privacy concerns may be mitigated by intermediaries managing data. | Privacy can be balanced based on account type and transaction type, with stronger privacy for indirect accounts. |

| Financial Inclusion | Potential for disintermediation of unbanked or underbanked populations. | Reaches unbanked/underbanked through existing financial structures. | Can offer both direct access for unbanked and leverage existing structures for wider reach. |

| Complexity | Requires central bank to handle all transactions and account management, increasing complexity. | Less complex for the central bank, but complexity may be shifted to intermediaries. | Complexity can vary depending on the chosen hybrid model and its implementation. |

| Legal Framework | Requires clear legal framework for central bank direct account management and transactions. | Existing legal frameworks for intermediaries may apply, but may need adjustments. | Legal framework needs to accommodate both direct and indirect accounts and transactions. |

Table 7-8: Features of all CBDC Architecture

Benefits

Central bank digital currencies (CBDCs) are a form of digital fiat currencies issued and backed by a central bank. They offer a range of potential benefits compared to traditional cash and electronic payment systems, including:

1. Improved Payment Efficiency and Accessibility:

- Faster and cheaper transactions: CBDCs can potentially offer faster settlement times and lower transaction fees, especially for cross-border payments.

- Financial inclusion: By giving the unbanked and underbanked access to financial services, CBDCs help advance financial inclusion.

- Reduced reliance on cash: CBDCs can lessen the need for physical cash, leading to lower printing and distribution costs.

2. Enhanced Security and Transparency:

- Improved security: CBDCs may be more secure because they are less vulnerable to theft and counterfeiting than cash or conventional electronic payments.

- Better transaction tracking: CBDCs can provide central banks with greater visibility into transaction activity, helping to combat money laundering and other financial crimes.

- Enhanced financial stability: CBDCs may give central banks better control over the money supply, potentially enabling them to manage inflation and financial crises more effectively.

3. Increased Innovation and Efficiency:

- Integration with smart contracts: CBDCs can promote innovation in the financial industry by assisting in the creation of new financial services and products.

- Financial innovation: Innovation in the financial industry can be promoted by CBDCs by facilitating the creation of new financial services and products.

- Enhanced digital economy: CBDCs can facilitate the development of the digital economy by providing a safe, secure, and efficient platform for online transactions.

4. Monetary Policy and Economic Growth:

- More effective monetary policy: With CBDCs, central banks may have greater control over monetary policy tools, potentially influencing economic growth and stability.

- Programmable money: By programming CBDCs with particular features like conditional expenditure, targeted stimulus, or automatic interest payments, new options for financial products and monetary policy are made possible.

- Reduced reliance on cash: Moving to CBDCs may lower the expenses and dangers of managing, printing, and distributing actual currency.

5. Potential Risks and Considerations:

- Privacy concerns: The potential for central banks to track individual transactions with CBDCs raises privacy concerns that must be addressed.

- Technological challenges: Issuing and managing CBDCs requires significant technological infrastructure and expertise.

- Impact on existing financial institutions: The introduction of CBDCs could potentially disrupt the business models of traditional banks and other financial institutions.

- Regulatory framework: Clear regulations and frameworks are needed to address financial implications and the sovereignty of CBDCs.

Central Bank Digital Currencies (CBDCs) are gaining traction as a potential evolution of traditional fiat currencies. These digital assets, issued and backed by central banks, offer a range of potential benefits for individuals, businesses, and the overall economy. Let’s explore some of the key advantages of CBDCs:

| Benefit | Description | Impact on Economy | Impact on Individuals |

| Price Stability | Maintaining a stable inflation rate | – Predictable economic environment for businesses and consumers. – Promotes long-term investment and economic growth. | Impact on the Economy |

| Financial Stability | Safeguarding the financial system from crises and disruptions. | – Protects depositors’ savings and prevents bank runs. – Maintains confidence in the financial system and promotes borrowing and lending. | – Reduces risk of financial losses and economic hardship for individuals. – Contributes to financial security and access to credit. |

| Payment System Efficiency | Facilitating and regulating efficient and secure payment systems. | – Reduces transaction costs for businesses and consumers. – Increases speed and reliability of payments. – Promotes financial inclusion and access to financial services. | – Simplifies and speeds up every day financial transactions. – Reduces reliance on cash and improves financial transparency. |

| Monetary Policy Implementation | Managing the money supply and interest rates to achieve economic objectives. | – Influences economic growth, unemployment, and inflation. – Can be used to stimulate the economy during downturns or control inflation during booms. | – Affects job opportunities, wages, and overall economic well-being. – Can provide short-term economic relief or long-term stability. |

| Lender of Last Resort | Providing emergency liquidity to banks in times of crisis. | – Prevents banking system collapse and protects depositors’ savings. – Maintains stability in the financial system and prevents widespread economic downturn. | – Protects individual savings and access to financial services. – Contributes to overall economic resilience. |

| Financial Sector Regulation and Oversight | Setting and enforcing regulations for banks and other financial institutions. | – Promotes fair competition and protects consumers from financial scams or predatory practices. – Maintains trust and confidence in the financial system. | – Protects individual financial interests and promotes responsible financial behavior. – Contributes to financial literacy and consumer protection. |

Table 7-9: Impact of CBDC to economy and individuals.

| Role | Description | Impact | Potential Risks |

| Monetary Policy: | Managing the money supply and interest rates to achieve price stability and economic growth. | – Controls inflation and deflation | – Can lead to high unemployment or financial instability if not managed properly |

| Financial Stability: | Overseeing the financial system to prevent systemic risk and ensure its smooth operation. | – Maintains confidence in the financial system | – Overly restrictive regulations can stifle innovation and growth |

| Banker to the Government: | Managing the government’s finances, including issuing debt and providing loans. | – Enables government to finance essential services | – Can lead to government overspending and inflation if not managed carefully |

| Currency Issuer: | Printing and distributing the national currency. | – Ensures a secure and reliable supply of money | – Counterfeiting and inflation risks |

| Overseer of Payment Systems: | Regulating and promoting the efficiency and security of payment systems. | – Provides faster and cheaper transactions | – Potential for data privacy concerns and cybercrime |

| Financial Advisor: | Providing the government with economic advice and expertise. | – Informs government policy decisions | – Potential for conflicts of interest with other goals |

| Lender of Last Resort: | Providing emergency loans to banks in times of crisis. | – Prevents bank runs and systemic financial collapse | – Moral hazard risk – banks may take excessive risks knowing they will be bailed out |

Table 7-10: Potential risks and impact in financial system.

Shariah-Compliant CBDC Architecture

Here are the fundamental requirements for Shariah-compliant architecture for Central Bank Digital Currency (CBDC):

Primary Requirements:

- Prohibition of Riba (Interest): No interest-based transactions or mechanisms.

- Prohibition of Gharar (Uncertainty): Clear and transparent transactions.

- Prohibition of Maysir (Gambling): No speculative or gambling-like activities.

- Prohibition of Haram (Unlawful) Activities: No transactions related to prohibited activities.

Secondary Requirements:

- Shariah Supervisory Board (SSB): Oversight and guidance.

- Compliance with Islamic Finance Principles: Adherence to Islamic finance standards.

- Transparency and Disclosure: Clear transaction records and auditing.

- Risk Management: Mitigation of risks through Shariah-compliant hedging instruments.

- Asset-Backed: CBDC is backed by Shariah-compliant assets.

- 100% Reserve Requirement: No fractional reserve banking.

- No Speculative Activities: No transactions involving speculation or leverage.

Technical Requirements:

- Blockchain or Distributed Ledger Technology: Secure, transparent, and tamper-proof.

- Cryptographic Techniques: Secure data encryption and authentication.

- Intelligent Contract Compliance: Shariah-compliant innovative contract design.

- Real-Time Gross Settlement (RTGS): Fast and secure transaction settlement.

- Auditable and Traceable: Transparent transaction records.

Governance Requirements:

- Shariah-Compliant Regulatory Framework: Clear regulations and guidelines.

- Central Bank Oversight: Monitoring and supervision.

- Collaboration with Islamic Financial Institutions: Partnership for Shariah compliance.

- Public Awareness and Education: Educating users about Shariah-compliant CBDC.

Countries with Shariah-Compliant CBDC Initiatives:

- Malaysia

- Indonesia

- Saudi Arabia

- United Arab Emirates

Figure 7-11: Shariah acquiesced Architecture

| Concept | Description | Key Features | Challenges | Potential Solutions |

| Monetary Policy | Implementing Shariah-compliant monetary policy tools to manage inflation and promote economic stability. | Ensuring accessibility and affordability of CBDCs, addressing financial literacy and education gaps, and tailoring CBDC features to specific needs. | Balancing Shariah principles with conventional monetary policy objectives, potential for limited policy flexibility. | |

| Financial Inclusion | Promoting financial inclusion for underserved communities within Islamic finance principles. | Bridging the digital divide, addressing technological barriers, and ensuring equitable access to financial services. | Addressing concerns about the potential for centralization, ensuring robust security and privacy measures, and fostering collaboration between Islamic finance experts and central banks. | |

| Regulatory Frameworks | Developing regulatory frameworks to oversee Shariah-compliant CBDCs and protect consumers. | Establishing clear legal and ethical guidelines, ensuring transparency and accountability in CBDC issuance and management, collaboration with Islamic financial institutions. | Central bank digital currencies (CBDCs) are designed to comply with Islamic financial principles. | |

| Technological Considerations | Designing CBDC technology that aligns with Shariah principles and promotes trust and security. | Harmonizing Shariah interpretations across jurisdictions, fostering international cooperation, and addressing potential regulatory hurdles. | Ensuring data privacy and security, promoting transparency in CBDC transactions, and avoiding centralized control mechanisms. | |

| CBDC Design | Utilizing profit-sharing models for liquidity management, zakat (charity) integration, and ethical investment guidelines. | Interest-free, asset-backed, transparent, and auditable. | Asset-backed CBDCs, profit-sharing mechanisms, algorithmic governance models, robust auditing, and oversight. | Avoiding fractional reserve banking, ensuring randomness in transactions, and complying with profit-sharing principles. |

| Shariah-compliant CBDCs | Digital versions of fiat currencies issued by central banks, adhering to Islamic financial principles. | Implementing Shariah-compliant monetary policy without interest rates, managing risks associated with asset-backed models, and ensuring equitable distribution and access. | Reconciling traditional monetary policy tools with Shariah principles, preventing interest-based activities, ensuring transparency, and ethical governance. | Exploratory stage, pilot programs in several countries. |

| Key Shariah Principles | Riba (prohibition of usury), Gharar (prohibition of excessive uncertainty), Maysir (prohibition of gambling), Ta’awwun (cooperation and mutual assistance). | Profit-sharing mechanisms based on real assets or economic activity, algorithmic models for inflation control, and transparent governance structures involving Shariah scholars. | Pilot programs in countries like Nigeria, Tunisia, and Pakistan are exploring different models and use cases. | Research and development phase, pilot programs testing different approaches. |

| Potential Benefits | Addressing concerns about central bank control, managing potential for misuse or manipulation, and ensuring equitable distribution of benefits. | Addressing concerns about potential for centralization, ensuring robust security and privacy measures, and fostering collaboration between Islamic finance experts and central banks. | Financial inclusion for unbanked populations, increased efficiency and transparency in financial transactions, and promoting ethical and sustainable finance. | |